Bookkeeping Contract Template

The bookkeeping services agreement is a contract between a customer and a bookkeeper for accounting services on a one-time or monthly basis. Banking records, receipts, income figures, and other financial information will very certainly be accessible to the bookkeeper. As a result, it is critical that the bookkeeper chosen be someone who can be trusted.

What is a bookkeeping agreement?

A client and a bookkeeper enter into a bookkeeping services agreement to have the bookkeeper perform accounting services on a one-time or ongoing basis.

It is possible that the bookkeeper will have access to banking records, receipts, revenue statistics, and other financial data.

The choice of the bookkeeper must be made carefully, and the person chosen must be dependable.

The actions involved in the systematic recording and orderly categorizing of a company's financial data are known as bookkeeping.

It is primarily a record-keeping task carried out to support the accounting process.

It plays a significant role in creating the organization's financial statements at the conclusion of the fiscal year.

Classifying financial transactions and occurrences is another issue that bookkeeping addresses.

To keep accurate financial records, transactions must be categorized in this way.

Creating source papers for the financial transactions and other business operations being conducted is another aspect of it.

There are many methods of book-keeping. The most common ones are the double-entry system and the single-entry system.

But even methods other than these, which involve the process of recording financial transactions in any manner, are acceptable book-keeping systems or processes.

Accounts Payable

Accounts Receivable

Bank Reconciliation

Bill Payment

Budget Preparation

Customized Reports

Detailed General Ledgers

Financial Statements

General Bookkeeping

Payroll and Check Registers

You could use Awesome Sign's easy to use electronic signature to easily edit pdf template.

What Qualities Should You Seek in a Bookkeeper?

This person must have the accounting knowledge and abilities required to reconcile the financial records of your company and enter data completely and accurately.

This comprises details regarding credit cards, bank accounts, fees, bills, checks, invoices, deposits, and credit card charges.

Your personal and corporate accounts can be organized with the assistance of a bookkeeper.

Finding someone you can trust is crucial, and it's crucial to spell out your expectations for their temporary or permanent work.

A detailed, explicit bookkeeping services contract is therefore required.

What specifics must be included in a bookkeeping services contract?

The following specifics should be included in your plan:

- Contact details for your client

- What assignments you're determined to complete

- Whether the project will be continuing or only last a certain amount of time

- When and what costs will be assessed

In line with expectations, your contract will also contain standard language regarding the non-employer nature of the bookkeeper's relationship with the client, confidentiality, indemnity, and, finally, dispute resolution procedures.

You will be able to choose which state's laws will apply to your agreement when you create it.

You can make more specific adjustments using the document tool as needed.

What specifics must be included in a bookkeeping services contract?

The following specifics should be included in your plan:

Contact details for your client.

What assignments you're determined to complete.

Whether the project will be continuing or only last a certain amount of time.

When and what costs will be assessed.

In line with expectations, your contract will also contain standard language regarding the non-employer nature of the bookkeeper's relationship with the client, confidentiality, indemnity, and, finally, dispute resolution procedures.

You will be able to choose which state's laws will apply to your agreement when you create it.

You can make more specific adjustments using the document tool as needed.

Types of Bookkeeping contract?

Assets

The items your company possesses, both tangible and intangible, are typically included in asset statements.

For instance, your company can have intangible assets like design patents and intangible assets like office supplies like computers.

You might also include the following items in your assets account:

Vehicles: Since they are real tools that your business utilises, company automobiles and other vehicles are tangible assets.

Company-owned machinery and equipment are also considered tangible assets because they are tangible physical items.

Property and buildings: As physical places or structures, company property and buildings are also tangible assets.

Copyrights:

Because they are intellectual property, copyrights are intangible.

Logo:

A company's logo is another intangible asset because it contributes to the brand image of the business and may affect how customers see its goods and services.

Trademarks:

Trademarks are non-physical protections that stop others from utilizing a company's logo or other brand elements, so you can include them with your intangible assets.

Expenses

The goods or services your business purchases to assist create additional revenue can be included in your expenditure account. This could involve investing in goods or services to increase the output of your distribution or production processes. Other costs could include:

-Employee compensation

-Marketing expenses

-Facility expenses

You can record both in your expense account if your business makes donations or trip arrangements.

To keep proper financial records for your business, it's crucial to keep personal costs out of your company expense account.

Income

The money that your business makes from selling its goods or services is tracked in income, also known as revenue, accounts.

Include any income that your business receives from investments as well.

However, you must record the investments themselves in your asset account.

In essence, your income account is where you keep track of the financial success of your business.

Liabilities

The liabilities account of your business may include things like unpaid debts, creditor payment commitments, and other upcoming payments.

Your liabilities may specifically include the following:

Commercial loans

Late utility payments

Unacceptable prices for facility upkeep

Overdrawn accounts

Other liabilities charges that pertain to your business may be documented.

To make sure your business is always aware of its existing liabilities, it's crucial to take into account accounting for any possible interest costs while recording these costs.

Equity

Equity accounts display the value that remains in your assets after subtracting all of your liabilities to illustrate the current value of your business.

Create a balance sheet with an exhaustive inventory of everything your business owns and owes in order to determine the worth of your equity account.

The entire liabilities of your company can then be subtracted from its total assets using the balance sheet as a guide.

This enables you to comprehend the equity level and existing value of your business, which can help you decide how to raise its value.

What I require to make bookkeeping agreement?

Every 30 calendar days, the accountant is required to give the Client an itemized invoice for services rendered.

Within 30 days of receiving an invoice, the client must pay it in full.

The Client's written consent is required before charging for any fees or costs not covered by this bookkeeping agreement.

Benefits of Bookkeeping agreement?

You'll Save Money

Keeping a tight grip on the total costs incurred is one of the most important aspects of running any organization.

The objective of a business owner is to lower overall operating expenses, and one way to do this is to regulate employee pay and compensation, typically by hiring fewer people.

An internal bookkeeper may receive substantial pay and benefits.

If the business owner, or one of the business owners, gathers invoices, payments, credit sales, and other important financial data, the business can function without a bookkeeper on staff.

The external bookkeeper can then receive the required paperwork for accounting purposes.

When compared to hiring a full-time accountant, outsourcing your accounting is often much less expensive.

Quicker response time for businesses

You will be able to respond swiftly to any changes that occur in the market or to your business if you have real-time information on the state of your accounts.

Knowing the amount of your resources and present costs will provide you precise insight into whether now is the ideal time to take action.

Simpler Audits

When you have a superior data-recording model, creating financial statements is considerably simpler and quicker.

It will be much simpler for you to conduct an audit if your accounts are neat and structured and not even a little bit old.

To determine exactly what was done, any auditor you hire only needs to see the detailed balance sheets and compare them with the statements.

They may rapidly prepare their report, and any errors will show up.

Improved Tax Prediction

Although the IRS will want an official financial statement from your business for taxation purposes, you will be better equipped to forecast the outcome if you have access to thorough balance sheets throughout time.

You can use them to keep an eye out for business trends at your firm and to feel more secure about the amount of taxes you'll have to pay at the conclusion of the fiscal year.

Quick Reporting

Despite the fact that you must wait for the accountant or auditor to complete their reports before you can conclude official financial statements, you will always have an updated balance sheet available to you in order to find out the state of the accounts at the time.

These facts will be available for you to share with anyone who is interested, boosting your confidence in both your management skills and the state of the business as a whole.

Bookkeeping contract helps you with the same.

Conflict of Interest Will Be Avoided

For some firms, such as partnerships, it can be risky to entrust one of the owners with the accounting.

Even when a record-keeping blunder is inadvertent, accusations of misbehavior have the potential to harm the commercial relationship.

The regrettable situation of having to decide between what is best for the business and what is best for the owner may arise.

This is not to imply that he wouldn't put the business first, but if something went wrong, people in the organisation may question his intentions.

Utilizing an impartial bookkeeping service can help owners feel more confident that all financial accounts are accurate, truthful, and free from bias while avoiding this mistake.

Constantly Obeying the Law

A competent bookkeeper will ensure that all of your accounts and books are up to date with the most recent legal changes and will always comply with the most recent legal requirements.

You can rely on the bookkeeper to correct any errors because they hold themselves and their work accountable.

This helps the bookkeeper save time and effort, which helps the business save money.

How can my bookkeeping agreement be assessed?

It may be expensive to hire a legal expert to comment on documents if you do it on your own.

Some lawyers won't even agree to review anything they didn't write.

If a lawyer does offer to assist you, they will probably still charge you their usual hourly rate.

Using the On Call legal network is a simpler choice. You can have a skilled contracts attorney analyze your agreements

Is bookkeeping a requirement?

Because precise accounting records are necessary for a firm to be sustainable, bookkeeping is critical.

A company can better manage its cash flow, fulfill its financial commitments, and organize its investments with the aid of accurate bookkeeping.

Do bookkeepers have to create a bookkeeping contract every time?

Even if your bookkeeping company is just getting started, it's important to document the specifics of your work in a contract.

When done properly, this document has the following advantages, so you might decide that you want it.

Each party is aware of the date of the invoice.

Everyone is aware of their roles and duties.

There are no unforeseen circumstances regarding the length of the engagement.

In many situations, anyone choosing not to make a Bookkeeping Agreement should be prepared for usual problems such timing concerns and fee uncertainties.

Use Awesome Sign to get started, and sign your pdf documents effortlessly.

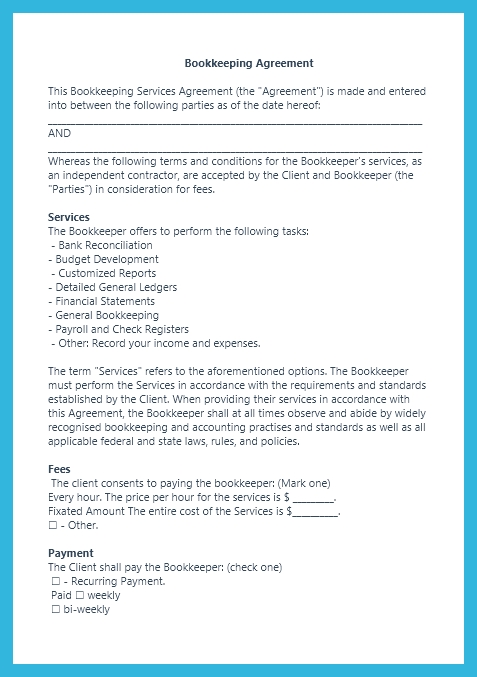

Bookkeeping Agreement Sample

Template Preview

Bookkeeping Agreement

This Bookkeeping Services Agreement (the "Agreement") is made and entered into between the following parties as of the date hereof:

__________________________________________________________________________________

AND

__________________________________________________________________________________

Whereas the following terms and conditions for the Bookkeeper's services, as an independent contractor, are accepted by the Client and Bookkeeper (the "Parties") in consideration for fees.

Services

The Bookkeeper offers to perform the following tasks:

- Bank Reconciliation

- Budget Development

- Customized Reports

- Detailed General Ledgers

- Financial Statements

- General Bookkeeping

- Payroll and Check Registers

- Other: Record your income and expenses.

The term "Services" refers to the aforementioned options. The Bookkeeper must perform the Services in accordance with the requirements and standards established by the Client.

When providing their services in accordance with this Agreement, the Bookkeeper shall at all times observe and abide by widely recognised bookkeeping and accounting practises and standards as well as all applicable federal and state laws, rules, and policies.

Fees

The client consents to paying the bookkeeper: (Mark one)

Every hour. The price per hour for the services is $ _________.

Fixated Amount The entire cost of the Services is $__________.

☐ - Other.

Payment

The Client shall pay the Bookkeeper: (check one)

☐ Recurring Payment.

Paid

☐ weekly

☐ bi-weekly

☐ monthly

☐ quarterly

☐ yearly

☐ Upon Completion.

Upon completion of the Services to the Client. ☐ Other. __________________________________________

Performance Standards

The bookkeeper declares and admits that she possesses the education, training, and certifications required to carry out the Services.

The Bookkeeper consents to deliver the Services in accordance with industry norms and expectations.

The Bookkeeper also consents to abide by all relevant legislation.

Obligations of the client

All financial data connected to the Client's personal and/or commercial affairs, including but not limited to all materials, data, and documents required to perform the Services under this Agreement, shall be provided by the Client solely to the Bookkeeper.

The Client understands and accepts that it is solely their duty to ensure the correctness of the financial information they supply to the Bookkeeper, and they agree to hold the Bookkeeper blameless from any liability deriving from such accuracy.

Working Situation

The Parties acknowledge and agree that the Bookkeeper shall provide the Services for the Client in a non-employee, non-agent, and non-broker capacity.

As an independent contractor, the Bookkeeper is obligated to adhere to all Internal Revenue Code regulations.

This includes, but is not limited to, paying all taxes owed on the money received from the Client for the payment of the Bookkeeper's employees, agents, brokers, and subcontractors.

The Bookkeeper is aware that the Client will not in any way deduct money from the Bookkeeper's total fees for services in order to pay for taxes.

Confidentiality

In the course of providing the Services contemplated herein, the Bookkeeper may have access to certain proprietary or confidential information of the Client.

The term "Confidential Information" shall mean all information, whether expressed orally, visually, electronically, or in machine-readable form, relating to the Client's business, affairs, products, marketing, systems, technology, customers, end-users, financial affairs, accounting, statistical data, documents, discussions, or other information developed by the Bookkeeper pursuant to this Agreement.

The Bookkeeper agrees to hold all such Confidential Information of the Client in strict confidence and shall not, without the express prior written permission of the Client, disclose such Confidential Information to third (3rd) parties or use such Confidential Information for any purposes whatsoever, other than the performance of its obligations hereunder.

After this Agreement expires or is terminated, the obligations under this section remain in effect.

Resolution of disputes.

- In the case of a dispute, the Parties agree to engage in good faith negotiations in an effort to reach a settlement.

- Arbitration and law of your choice. Any claim or dispute that is unable to be settled via negotiation must be arbitrated in the State of. Regardless of any potential conflicts of law, the laws of the State of ________________ shall govern the interpretation of this Agreement.

- Lawyer's fees. The party that wins the arbitration is entitled to all of its legal costs, including but not limited to attorneys' fees.

###Assignment

Without the Client's prior written consent, the Bookkeeper shall not be permitted to assign any of its rights under this Agreement or to subcontract the execution of any of its obligations or duties.

Any effort by the Bookkeeper to assign, transfer, or subcontract any rights, responsibilities, or obligations arising under this agreement is null and void and has no legal effect.

The whole agreement

The Parties' understanding of their rights and obligations is fully expressed in this Agreement.

Any other written or verbal discussions between the Parties are superseded by this Agreement.

This Agreement may not be amended except in a writing signed by the Parties.

Connection between the Parties

Independent contractors are what the Parties to this Agreement are.

Neither Party is the other Party's agent, partner, representative, or employee.

Indemnification

Each party shall, at its own expense, defend the other party, its officers, directors, employees, sublicensees, and agents from and against any and all claims, losses, liabilities, damages, demand, settlements, loss, expenses, and costs, including attorneys' fees and court costs, which arise directly or indirectly out of or related to any breach of the agreement.

Waiver

If either Party fails to exercise a right, power, or privilege granted by the terms of this Agreement, that failure will not be interpreted as a waiver of that right, power, or privilege or the exercise of any other rights, powers, or privileges in the future.

Severability

The remaining provisions of this Agreement shall remain in full force and effect even if any provision of this Agreement is found to be illegal, invalid, or unenforceable under current or future laws.

Severability. If any provision of this Agreement is found to be illegal, invalid, or unenforceable under current or future laws, such provision shall be severable.

By signing below, the Parties acknowledge and agree to the terms of this Agreement.

Bookkeeper’s Signature_________________________________ Date ______________________________

Client’s Signature _______________________________ Date ________________________________